Banks across the globe are in the pursuit of transforming themselves into a digital business. To be a real digital business banks need to address the needs of the evolving and well aware “digital consumer”. This will entail that banks adopt a “need servicing” business model as against the current “product provisioning” model. What does this mean? We believe that banks should challenge themselves to become purchase enablers instead of playing a utility role of purchase funders. We also believe that this is foremost a mind-set issue more than anything else. For banks that do want to take the leap, the question of feasibility & viability become paramount and such a mindset gets killed at the drawing board itself.

Banks across the globe are in the pursuit of transforming themselves into a digital business. To be a real digital business banks need to address the needs of the evolving and well aware “digital consumer”. This will entail that banks adopt a “need servicing” business model as against the current “product provisioning” model. What does this mean? We believe that banks should challenge themselves to become purchase enablers instead of playing a utility role of purchase funders. We also believe that this is foremost a mind-set issue more than anything else. For banks that do want to take the leap, the question of feasibility & viability become paramount and such a mindset gets killed at the drawing board itself.

To answer the challenge of feasibility and viability, banks need to adopt “design thinking” as a corporate philosophy. This will enable banks to potentially transform their current business model including impacting revenue model, channels, go to market approach and set up an evolutionary trajectory to the partner ecosystem.

The auto finance marketplace is so diverse and fragmented that it provides banks the right opportunity to evolve the “needs servicing” business model with an evolutionary disruptive approach to the current business model.

If we take US as an example, the fragmentation in the auto finance space can be substantiated by the following data:

- No single FI had more than 5.8 % of market share

- The top 10 % financial institutions accounted for only 37.7 % vehicle finance transactions

- Only 55 % of finance transactions were funded by banks

- Total of around 54000 + franchised and non-franchised dealership in US

There is enough and more evidence available today for how “digital” as a channel is being leveraged increasingly by the consumers in the auto purchase journey of “awareness”, “consideration” and “purchase”. This consumer behaviour is good enough trigger for banks and dealerships alike to attract the consumers and engage them on digital channels.

We at vLendRight believe that banks have an opportunity like no other entity to monetize the evolving consumer digital behaviour. Banks are the custodians of “customer data” which is foundational to understanding the “what”, “why” and “how” behind the customer’s auto purchase decision. Banks also have an existing robust partnership with dealerships which potentially could enable them to play the role of the glue that enables an end to end purchase journey.

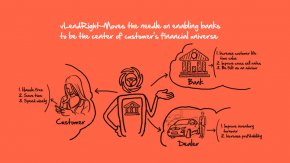

vLendRight as a platform helps banks embrace design thinking as a philosophy to evolve the “needs servicing” business model by making the proposition “technologically feasible” and also “economically viable”. vLendRight as a platform inverts the role of the bank in the customer auto purchase journey by enabling the banks to be the “guiderails” which brings the “customers” and the “dealers” on to a common platform .The platform simultaneously achieves two things:

- 1) Digitally emulates the customer’s current journey by using core design thinking constructs including journey mapping, and empathy mapping

- 2) Reimagines the information systems that the customer uses their purchase journey as a harmonised “value ecosystem” of partners and data syndicates

vLendRight as a platform will help banks gain market share in auto finance and also re-inforce their brand of “customer first banking”. The platform will help partner dealers with a robust sales enablement and forecasting platform driving both the volume and speed of inventory turnover.

vLendRight is one of the early stage startup’s which made it to the finals of FF16. To know more about vLendRight, Meet us in FF16 on Jan 25 -26 in HK.

RELATED VIDEO